Money

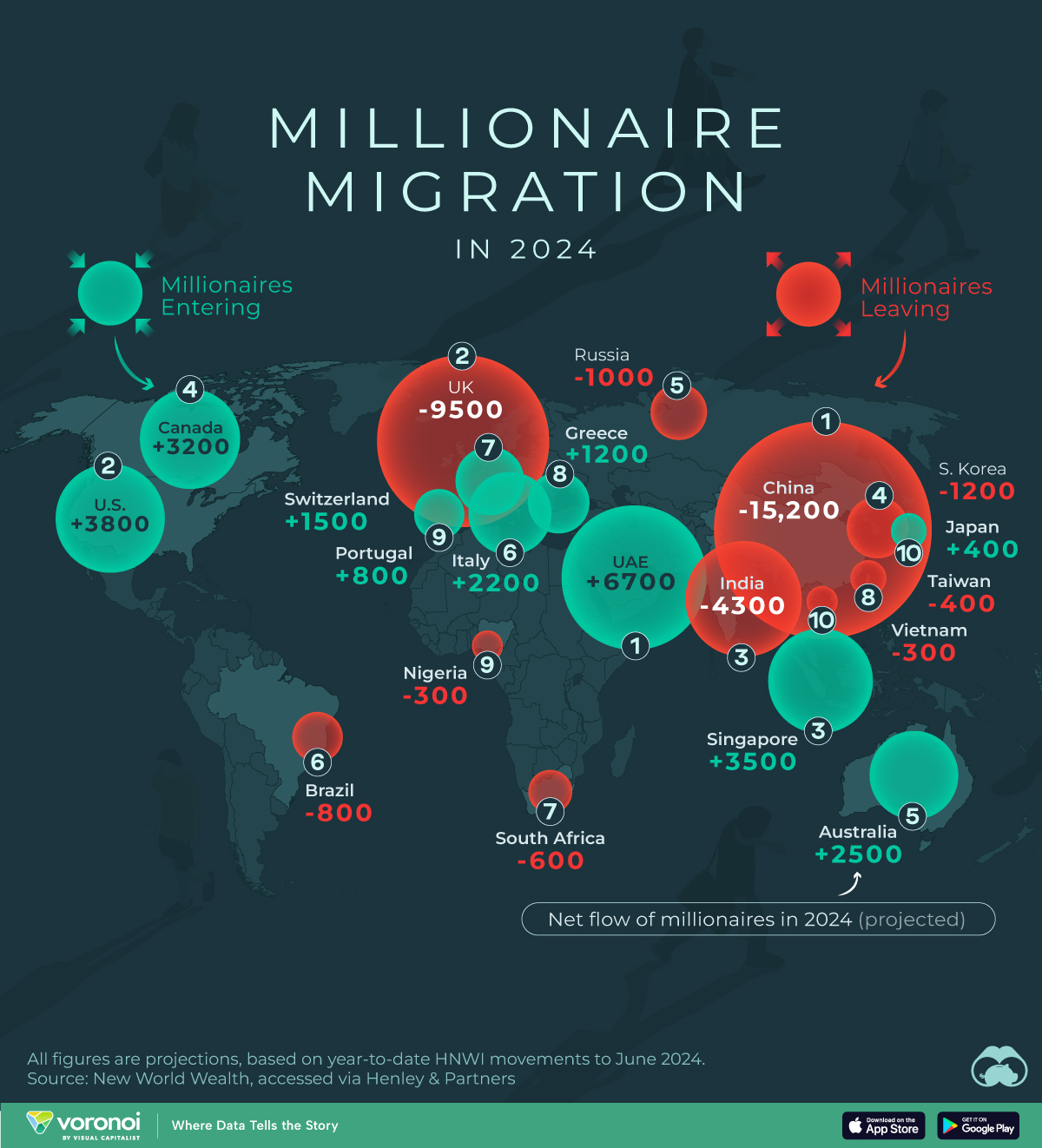

Mapped: Millionaire Migration in 2024

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Visualizing Millionaire Migration in 2024

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The United Arab Emirates is set to attract the most millionaires in 2024, while China and the UK are expected to lose the largest number of high-net-worth individuals (HNWIs).

This graphic shows the top 10 countries projected to have the highest net inflows or net outflows of HNWIs in 2024. HNWIs have a liquid investable wealth of $1 million or more. All figures come from the Henley Private Wealth Migration Report 2024.

Why is Attracting Millionaires Important?

According to Henley & Partners, 20% of HWNIs are entrepreneurs (rising to 60% for centi-millionaires and billionaires). As a result, countries that attract HWNIs from other parts of the world may see powerful benefits like job creation and investment.

Countries Attracting the Most Millionaires in 2024

| Rank | Country | Net flow of millionaires (2024P) |

|---|---|---|

| 1 | 🇦🇪 UAE | 6,700 |

| 2 | 🇺🇸 U.S. | 3,800 |

| 3 | 🇸🇬 Singapore | 3,500 |

| 4 | 🇨🇦 Canada | 3,200 |

| 5 | 🇦🇺 Australia | 2,500 |

| 6 | 🇮🇹 Italy | 2,200 |

| 7 | 🇨🇭 Switzerland | 1,500 |

| 8 | 🇬🇷 Greece | 1,200 |

| 9 | 🇵🇹 Portugal | 800 |

| 10 | 🇯🇵 Japan | 400 |

The UAE’s strategic focus on economic diversification and government investment has positioned it as a global economic powerhouse.

The country has seen significant investments in tourism, real estate, logistics, financial services, and technology markets.

In addition, the adoption of international standards in regulatory and market frameworks, coupled with attractive tax initiatives, has drawn young entrepreneurs worldwide to the country.

According to Warwick Legal Network, the UAE accounts for over 30% of foreign direct investment inflow to the MENA region.

Countries Losing the Most Millionaires in 2024

| Rank | Country | Net flow of millionaires (2024P) |

|---|---|---|

| 1 | 🇨🇳 China | -15,200 |

| 2 | 🇬🇧 UK | -9,500 |

| 3 | 🇮🇳 India | -4,300 |

| 4 | 🇰🇷 South Korea | -1200 |

| 5 | 🇷🇺 Russia | -1000 |

| 6 | 🇧🇷 Brazil | -800 |

| 7 | 🇿🇦 South Africa | -600 |

| 8 | 🇹🇼 Taiwan | -400 |

| 9 | 🇳🇬 Nigeria | -300 |

| 10 | 🇻🇳 Vietnam | -300 |

Meanwhile, uncertainty over China’s economic trajectory and geopolitical tensions have led millionaires to leave the country. China saw the world’s biggest outflow of high-net-worth individuals last year and is expected to see a record exodus of 15,200 in 2024.

Similarly, the UK is expected to lose 9,500 millionaires this year, on top of the 16,500 millionaires it lost in the six-year period following Brexit.

This is an interesting and noteworthy reversal in fortune, since historically, the UK has drawn wealthy families from Europe, Africa, Asia, and the Middle East.

Economy

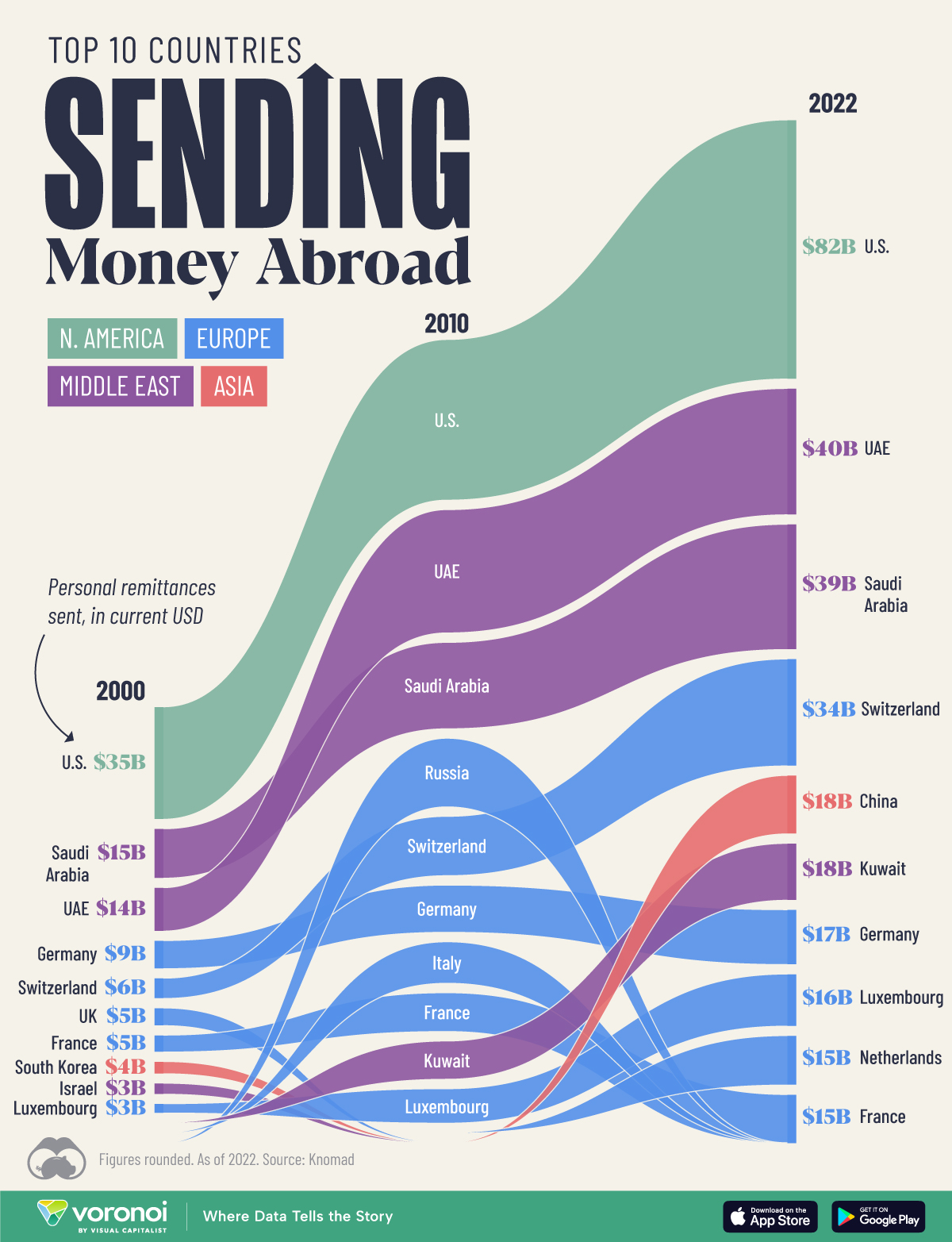

Ranked: The Countries Sending the Most Remittances Abroad

Countries which host large diasporas from around the world rank highly on this list of places sending the most remittances abroad.

Ranked: The Countries Sending the Most Remittances Abroad

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

We chart the top 10 countries by the most remittances sent, in current U.S. dollars, based on 2022 data from Knomad.

Specifically, these transfer totals shown represent personal remittances, or money sent between residents in one country to another, including personal transfers and compensation for work done abroad. It does not include, and is separate from, foreign investment.

Top 10 Countries by Personal Remittances Sent (2000-2022)

The U.S. has consistently been home to the world’s largest immigrant population (45 million people in 2022), a key reason for topping the ranks of sending money abroad over the last two decades.

As a result, countries with largest diasporas in the U.S.—including Indian, the Philippines, and Mexico—tend to be the biggest recipients of these flows.

| Top Countries Sending Money Abroad | 2000 | Top Countries Sending Money Abroad (2022) | 2022 |

|---|---|---|---|

| 🇺🇸 U.S. | $35B | 🇺🇸 U.S. | $82B |

| 🇸🇦 Saudi Arabia | $15B | 🇦🇪 UAE | $40B |

| 🇦🇪 UAE | $14B | 🇸🇦 Saudi Arabia | $39B |

| 🇩🇪 Germany | $9B | 🇨🇭 Switzerland | $34B |

| 🇨🇭 Switzerland | $6B | 🇨🇳 China | $18B |

| 🇬🇧 UK | $5B | 🇰🇼 Kuwait | $18B |

| 🇫🇷 France | $5B | 🇩🇪 Germany | $17B |

| 🇰🇷 South Korea | $4B | 🇱🇺 Luxembourg | $16B |

| 🇮🇱 Israel | $3B | 🇳🇱 Netherlands | $15B |

| 🇱🇺 Luxembourg | $3B | 🇫🇷 France | $15B |

Note: Figures rounded.

Similarly, immigrants make up nearly 80% of the population in the UAE (ranked #2 with $80 billion sent), the highest proportion of any country in the world.

Setting the countries sending the most money abroad side-by-side with those receiving money from abroad, reveals broad geographic patterns. Advanced economies (in North America and Europe) are the biggest senders to developing economies in Asia and Africa.

Finally, Switzerland, Netherlands, and Luxembourg are considered offshore financial centers and can be used as intermediary stops in the movement of money through the world.

Why are personal remittances important anyway? To start, a staggering one billion people (roughly one out of eight people in the world) depend on money sent back home. In 2022, 200 million migrant workers sent $800 billion to their families in home countries. Three-quarters of the money received is spent on basic necessities like food, medical, and housing expenses.

Thus, personal remittances represent, perhaps, one of the biggest informal engines of social transformation.

-

Markets2 weeks ago

Markets2 weeks agoThe Growth of $100 Invested in Jim Simons’ Medallion Fund

-

Misc1 week ago

Misc1 week agoChart: Which Countries Eat the Most Instant Noodles?

-

Misc1 week ago

Misc1 week agoRanked: The 10 Highest-Grossing Concert Tours of All Time

-

Maps1 week ago

Maps1 week agoCharted: Unauthorized Immigrants in the U.S., by Country of Origin

-

Misc1 week ago

Misc1 week agoRanked: The Top 10 U.S. Pizza Chains by Market Share

-

Maps1 week ago

Maps1 week agoMapped: 15 Countries with the Highest Smoking Rates

-

Markets1 week ago

Markets1 week agoRanked: Which NHL Team Takes Home the Most Revenue?

-

Maps2 weeks ago

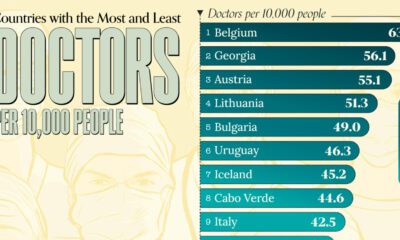

Maps2 weeks agoMapped: Highest and Lowest Doctor Density Around the World